Table of Contents

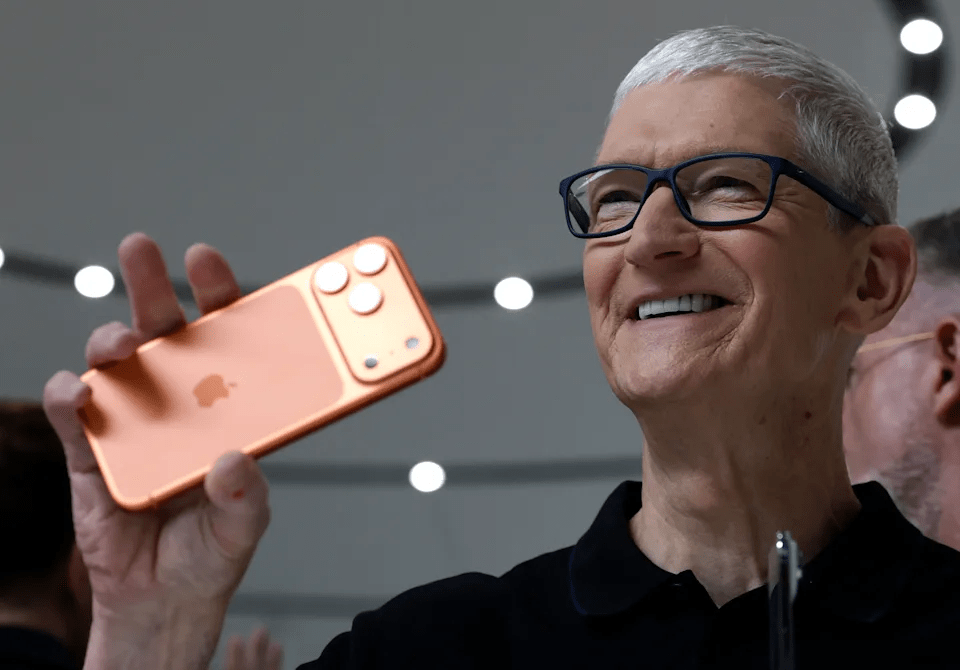

The tech world is closely watching Apple as it prepares for a generational shift in leadership. The focus keyword Apple figures prominently as the company gears up for the next phase under potential new CEO John Ternus, currently Senior Vice President of Hardware Engineering. Under current CEO Tim Cook, Apple has grown from roughly a $350 billion market cap to around $4 trillion.

This transition isn’t simply about a new name in the top seat—it signals a strategic repositioning. As the Apple story unfolds, the implications span hardware, software, ecosystem, and global markets.

In this article, we examine the trend, the specifics of Ternus’s rise, how this affects Apple’s business and industry at large, and what to keep an eye on moving forward.

The Succession Strategy at Apple

Setting the Stage

The keyword Apple comes into sharp focus when we look at how the company is preparing for a leadership change. Apple’s board is reportedly accelerating succession planning for Tim Cook’s eventual departure, with the company indicating the next CEO may be named as early as after its next earnings report.

This is a significant moment: Apple has maintained executive stability for years, but the departure of long‐time COO Jeff Williams and recent shifts show the company is paving the way for change.

Impacts on Strategy & Industry

For Apple, a leadership handover means more than a change of faces—it may shift the playing field. With hardware engineering at the helm of the successor’s profile, Apple appears to emphasise device innovation, integration across platforms, and hardware‐software synergy. This resonates with the “Apple” brand promise of seamless experiences. For the wider tech industry, a hardware‐centric CEO at Apple may increase competitive pressure on rivals in device design, chip development, and ecosystem control.

Essentially, Apple’s transition strategy presents a ripple effect: competitors, suppliers, and developers will adjust to Apple’s next chapter. We thus see the Apple succession as a trend‐setter in big tech leadership transitions.

Who is John Ternus, and why does he matter

Career and Credentials

The keyword Apple emerges again when examining John Ternus’s biography. He joined Apple in 2001 and rose through the product design and hardware teams. He now oversees hardware engineering across Apple’s flagship lines: iPhone, iPad, Mac, AirPods, and Apple Silicon.

Ternus holds a bachelor’s in mechanical engineering from the University of Pennsylvania and has been described as a “quiet but commanding” architect behind Apple’s hardware success.

What He Brings & What He Faces

At Apple, the implications of Ternus’s ascendancy are tangible. He brings deep technical expertise, intimate knowledge of Apple’s product pipeline, and the trust of the board. That aligns with Apple’s culture of internal succession. Conversely, he faces challenges: Apple must accelerate its push into AI, mixed reality, and other growth drivers. Stakeholders will assess whether a hardware‐centric leader can successfully steer Apple’s services, software, and ecosystem expansions. Don’t miss our recent post about Xiaomi Ups 2025 EV Delivery Target to 400,000 After Reaching Break-Even.

What’s Changing for Apple’s Business Direction

Hardware Reinforcement & Ecosystem Leverage

As we focus on Apple, one major shift is the possibility that hardware will regain a more dominant role in the company’s strategy. Under Cook, Apple emphasised services, wearables, and ecosystem growth alongside devices. The possible new CEO’s hardware engineering background suggests a future where Apple places heavier bets on next‐generation devices, whether foldables, AR glasses, or high‐performance Macs.

This may also mean tighter integration of hardware with software and services, reinforcing Apple’s ecosystem moat. For the industry, this signals renewed competition in hardware innovation: suppliers, chipmakers, and device manufacturers will feel the pressure.

Operational Continuity vs Innovation Imperative

Apple’s business direction under Ternus may balance two imperatives: continuity in operations (supply chain, margins, global scale) and a stronger push into innovation. Apple’s scale remains massive $4 trillion valuation and a strong global presence.

But in the tech landscape of 2025, where AI, spatial computing, and regulatory scrutiny dominate, Apple must evolve quickly. A leadership change at Apple could mean more aggressive innovation investing, adjusted timelines, and possibly new product categories. The takeaway: Apple’s business will likely maintain its stability but adapt to a faster‐moving innovation rhythm.

Implications for Stakeholders

For Developers, Consumers, and Suppliers

In the Apple ecosystem, every stakeholder stands to gain or shift in response. Developers can expect deeper hardware capabilities, new APIs, tighter integration, and possibly a greater focus on custom silicon. Consumers may see more differentiated devices, perhaps earlier access to emerging technologies such as AR and on‐device AI.

Suppliers and contract manufacturers will need to adapt to Apple’s evolving hardware roadmap, potentially increasing investments and capacity in advanced manufacturing. The broader takeaway: Apple’s leadership change will reverberate throughout the value chain.

For the Tech Industry and Competitive Landscape

Apple’s potential shift in leadership impacts the tech industry at large. Competitors such as Google, Samsung, and Microsoft will monitor Apple’s emphasis on hardware and ecosystem leverage. If Apple moves more aggressively into mixed reality or intelligent devices, rivals may accelerate their own hardware‐software strategies.

For investors and analysts, Apple’s brand and scale provide a stable anchor, but a change in leadership introduces new strategic biases and risk profiles. In short, Apple’s transition is not isolated; it reshapes the competitive map.

Table: Snapshot of Key Data

| Metric | Figure/Detail |

|---|---|

| Apple’s Market Capitalisation | Approximately US$4 trillion |

| John Ternus at Apple since | Joined in 2001 |

| Tim Cook’s Tenure | Joined in 2001 |

| Potential CEO Announcement | Likely after the January 2026 earnings report |

| Key Prior Role of Ternus | SVP of Hardware Engineering, leading product lines |

Bottom Line

The keyword Apple is at a pivotal juncture. With John Ternus emerging as the likely successor to Tim Cook, the company may embark on a new chapter where hardware innovation takes centre stage alongside ecosystem strength. For Apple’s business, this means leveraging existing scale while moving faster into AI, mixed reality, and deeper integration. For the broader industry, it signals an era where device excellence, chip leadership, and holistic experiences matter more than ever. As stakeholders from consumers to suppliers and competitors pay close attention, one clear takeaway emerges: Apple’s next act won’t just be incremental. It has the potential to define tech’s next decade.