Table of Contents

In the event of a death without a will, probate is required for the estate. Under the rules of intestate succession, assets are passed to relatives who survive the deceased. Surviving spouses typically receive the largest share, followed by children. Parents and siblings inherit the remainder. Intestate succession laws only pass your assets to legal and blood relatives, so friends, stepchildren, and charities cannot inherit from you. It can cause unnecessary friction among loved ones after your death.

What Is Intestacy?

If you die without a will, your estate is said to have died “intestate.” A Will gives you the power to decide who should receive your property after your death. However, if you pass away without a will, state law decides who will inherit your possessions. State intestacy laws determine intestate inheritance.

Intestacy laws vary by state, but generally, they are based on the idea that your property should devolve upon people with bloodline relationships with you. It includes spouses, children, parents, siblings, and grandparents. However, modern state statutes are shifting away from keeping property within a family, giving greater rights to common-law spouses, and easing restrictions on inheritance by illegitimate children.

A vital part of any intestate estate is the affidavit of heirship. This document lists the identification information for each heir. It is often a required step in the probate process and can help to speed up the process by reducing the number of court visits. Having a will is also a way to avoid the expensive probate process and minimize taxes. Financial accounts and life insurance policies are examples of assets that, upon a person’s death, transfer directly to the designated beneficiary, avoiding the probate process. It is essential to review your beneficiaries regularly and consider adding new ones.

What Are the Benefits of Having a Will?

You get to choose who inherits your property, which is the main advantage of having a will. The intestate succession in California will be the basis for dividing your assets. Your purchases are divided by these laws, usually according to your marriage status and lineage. It can lead to family disputes and other issues you may not want. In addition, the estate administration process is more complicated when there is no will. It can increase expenses and delay the distribution of your estate to heirs. Finally, the state may take control of your property when there is no will, which can have tax consequences for your heirs.

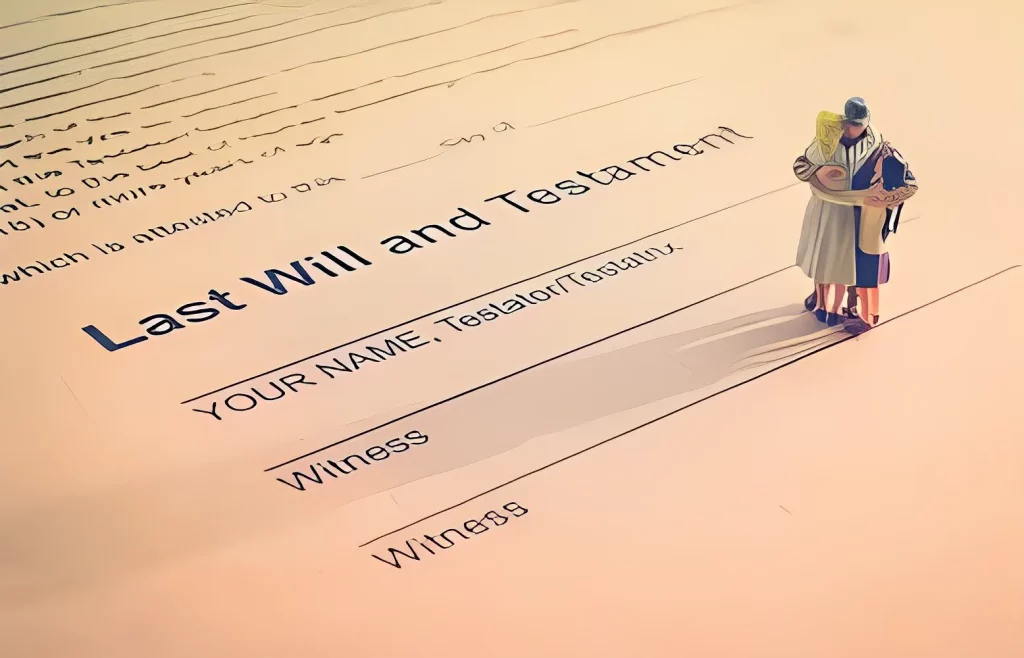

Leaving a will guarantees your loved one’s well-being and the execution of your final wishes. It will also avoid family conflicts and other problems that can occur when a person passes away intestate.

Having a will can help you avoid a lot of the hassle and expense associated with dying intestate. Suppose you are looking for an estate planning attorney with experience. In that case, they can draft a will that satisfies all legal requirements set forth by the state, such as being executed voluntarily and free from abuse or coercion. Additionally, the will must be witnessed by two people and signed by you as the testator in your handwriting.

How Can I Avoid Intestacy Intestate Succession?

If you die without a will or your will is deemed invalid, the state determines how to divide your estate. Known as dying intestate, this process can get complicated and can result in your family fighting over what you left behind. The legal guidelines in every state are exceptional, however generally, assets are divided among your partner, children, dad and mom, and siblings. Each nation has a set of policies that dictate who receives what, and there may be no assurance that your loved ones get what you want them to have. Besides proscribing who can inherit your house, the intestacy legal guidelines do not allow you to name a guardian on your children. It means your kids will be positioned in foster care if the court docket unearths an appropriate guardian for them.

Intestacy laws also do not allow you to leave your property to friends or causes that are important to you. Instead, you must specifically list them in your will.

Dying intestate also makes the probate process longer and more expensive than if you had made a will. In addition, your loved ones may suffer from the emotional stress and financial strain of probate proceedings. To avoid this, you should create a Will and seek legal advice to ensure your wishes are respected. Also, consider minimizing the impact on your family and others by transferring assets outside your estate, such as in a trust or to beneficiaries, before you pass away.

What Are the Drawbacks of Intestacy?

Intestate succession is the process that your state uses to determine who receives your assets if you die without a will. Every state has rules for handling a situation like this, so it’s essential to check out your state’s laws before deciding not to make a will. The basic rule is that your spouse gets priority, then your children and grandchildren also get a share. After that, the closest surviving relatives get their portion of the estate. It typically includes parents and siblings but could consist of aunts, uncles, or cousins. The estate escheats to the state if the probate court finds no surviving heirs.

Certain kinds of belongings can be transferred through intestate succession, along with deeds, financial institution bills, existence coverage rules, and more. It may be irritating in case you want to leave those assets to human beings other than your partner and children, for example. Intestate inheritance can also lead to family disputes and inefficient asset distribution. It can also result in unexpected tax consequences that can be costly for your beneficiaries. With proper estate planning, you can avoid these issues and ensure that your legacy is inherited by the people you want to inherit it. The best way to do this is by making a will.

Liam Stephens is a dynamic and skilled blogger, recognized for his ability to identify trends and create compelling content. As the founder of Remi-Portrait.com, Liam has become a reliable source of information across various fields such as food, technology, health, travel, business, lifestyle, and current events. He specializes in delivering up-to-date technology news and insights, catering to the diverse community that surrounds Remi-Portrait.com. His proficiency and engaging writing style have earned him a dedicated audience, solidifying his reputation in the digital sphere.