Table of Contents

Starting your own company comes with a lot of headaches, from securing financing to developing the right financial strategies. It can be overwhelming to navigate the world of business banking.

While large commercial banks might seem like the default option, credit unions offer unique advantages and financial strategies that directly support business growth in today’s economy. In this post, we’ll uncover how a partnership with a credit union could provide the catalyst you need to propel your company to the next level.

The Vital Role of Credit Unions in Supporting Business Growth

Businesses are the backbone of the American economy. However, many business owners face obstacles in accessing the financial services they need to start, sustain, and grow their companies. Despite these challenges, entrepreneurs can find solace in a vibrant business landscape, supported by credit unions.

If you’re an entrepreneur from Idaho and are struggling to meet financing needs, Boise Credit Union. Unlike large commercial banks, which prioritize shareholder returns, credit unions prioritize community development as not-for-profit cooperatives owned by members

Their emphasis on people over profits uniquely positions them to support businesses. Now let’s explore how they help businesses.

Providing Critical Financing

Getting access to capital is consistently ranked as one of the biggest challenges for business owners. Credit unions help fill this void by providing financing options tailored to business needs, including

- Small business loans and lines of credit with flexible qualification criteria beyond just credit scores. This increases approval rates.

- Microloans under $50,000 to help the smallest businesses and startups secure seed funding.

- Lower interest rates and fees that improve business cash flow.

- SBA-guaranteed loans backed by the government to facilitate financing.

Delivering Personalized Service

Beyond just capital, businesses thrive on relationships and expertise. Credit unions commit staff specifically to serve business members. These professionals take the time to understand each business’ circumstances and provide customized guidance on topics like:

- Cash flow management and financial planning

- Choosing the optimal loan and accounting solutions

- Navigating regulations, taxes, and compliance issues

- Accessing business networks and local resources

Fostering Community Development

With deep roots in their communities, credit unions actively participate in programs that support business growth, such as:

- Offering workshops, seminars, and mentorships on critical skills like marketing, compliance, and strategic planning.

- Sponsoring networking events and business plan competitions to connect entrepreneurs with resources.

- Providing educational resources and training programs to minority- and women-owned business enterprises.

- Investing deposit dollars into local business lending and development projects.

This commitment to their communities creates an ecosystem where businesses can thrive. For business owners seeking a financial ally invested in their success, credit unions are an ideal partner.

Their goals align with supporting local business growth and community prosperity. By leveraging their services, businesses gain the financial capabilities and network of resources needed to achieve their dreams.

Credit Union Business Loans – Financing That Fits Your Needs

Access to capital is essential for any growing business. Yet securing financing from traditional banks is often laden with frustrations – strict requirements, high-interest rates, and lack of flexibility. Credit union business loans break this mold with advantages like

- Lower interest rates and fees – Credit unions focus on community service over profit. This translates into more affordable loan rates.

- Higher approval rates – Credit unions may use more personalized criteria when evaluating loan applications. This leads to higher approval odds for small businesses.

- Flexible terms – Credit unions craft loan terms aligned with each business’s cash flow and goals. This flexibility facilitates growth.

- Faster processing and decision times – The community-based organizational structure of credit unions enables faster loan processing and decisions.

- Local community focus – Since credit unions invest in the communities they serve, loan dollars stay local to create jobs and boost the neighborhood economy.

Before applying for a credit union business loan, research the credit union’s requirements and gather needed documents like financial statements and business plans. Ask about any consulting services to strengthen your application. Leveraging credit union financing sets businesses up for scalable, sustainable growth.

Financial Strategies to Fuel Growth

Beyond just loans, credit unions also offer invaluable services to develop financial strategies for business growth. Their expertise can optimize how you manage assets, plan investments, and structure your financial footprint. Specific opportunities include:

- Asset management assistance – Credit unions provide consulting on how to grow assets efficiently. Their advice on cash flow, accounts receivable, and more can directly bolster your bottom line.

- Investment strategies – Financial advisors at credit unions can suggest tailored investment approaches aligned with your business goals. This helps money work harder through vehicles like certificates of deposit (CDs), money market accounts, mutual funds, and more.

- Retirement planning – Many credit unions offer IRA and 401K services. They can advise retirement plans that attract talent while optimizing tax benefits.

- Insurance products – From business property insurance to life insurance, credit unions often provide diverse coverage options customized for business needs.

Regular meetings with credit union advisors ensure you capitalize on these types of financial strategies. Their guidance provides an invaluable roadmap for growth.

Credit Union or Bank – Which is Best for Business?

When researching financial institutions, the credit union vs bank debate inevitably arises. While banks offer similar services, credit unions excel in key areas like:

| Credit Union | Bank |

| Not-for-profit model focused on members’ | For-profit model prioritizing shareholders’ |

| Lower interest rates on loans and credit products’ | Higher interest rates to drive profits |

| Relationship-based service | Transaction-based service |

| Profits returned to members through better rates and lower fees | Profits paid out to shareholders |

| Personalized services and local community focus | More impersonal service and broad focus |

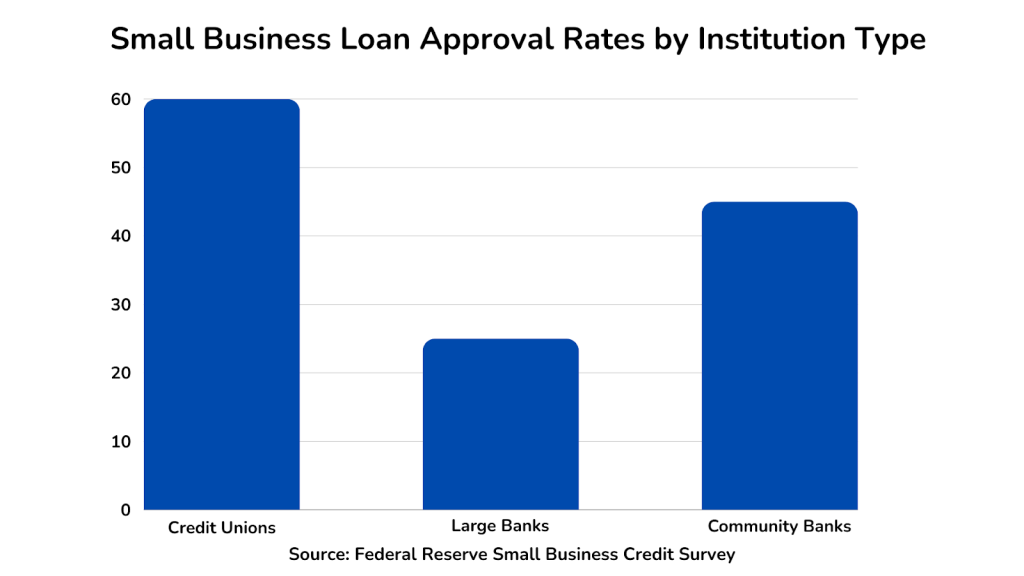

Now take a look at the below chart comparing small business loan approval rates by various institutions.

This comparison shows that credit unions align more closely with small business goals. By choosing a credit union, you benefit from service motivated by your success, not their bottom line.

Streamlining Operations With Digital Solutions

Beyond in-person services, credit union digital banking solutions provide convenience and streamline operations. Mobile and online tools like:

- Online loan and account applications

- Bill pay and invoicing

- Account management and monitoring

- Cash flow analysis

- Mobile check deposit

These types of innovations simplify financial management. Optimizing digital platforms frees up time and resources to focus on business growth.

Credit unions also deploy user-friendly analytics dashboards for tracking financial KPIs. Having visibility into cash flow, profit and loss, and other metrics enables data-driven decision-making. Choose a credit union that invests heavily in digital capabilities to position your company for the future.

Creating Financial Products That Meet Your Needs

Every business has unique needs. Custom financial products from credit unions can provide tailored solutions. Some examples include:

- Industry-specific loan products – Credit unions create targeted financing options for sectors like healthcare, agriculture, technology, and more. This specialized approach boosts approvals.

- Equipment financing loans – Funding for essential equipment and vehicles custom-fit for your business profile and projected cash flows.

- Working capital loans – Short-term loan products designed to finance daily operations and optimize cash flow management.

- Merchant services – Credit unions offer merchant services and POS solutions to support retail, e-commerce, and service businesses.

In addition to digital banking support, these customized products demonstrate that credit unions go the extra mile to facilitate business growth. Discussing your specific business needs enables them to develop financial solutions suited to your success.

Ready to Grow with a Credit Union Partner

A credit union partnership could catalyze your business’s success whether you’re a startup or established company. Their affordable loans, smart financial strategies, and customized services are designed to help local businesses thrive. Research options and find a credit union that fits your needs to unlock new financial tools for growth.

FAQs on Partnering With Credit Unions

We’ve covered a lot of ground on how credit unions support business growth. Here are answers to some frequently asked questions on getting started with credit union business membership:

How do I choose the right credit union for my business?

Research options locally and nationally. Look for a robust suite of business banking services. Also, consider specialization in your industry vertical. Set up consultations to discuss your business model and goals. This enables finding the best fit.

What documents do I need to open a business account?

Standard documents include

1. Business plans/financials

2. Certificates of Formation

3. EIN confirmation letter

4. Ownership/management information

5. Valid government-issued ID

What are the membership requirements?

Most credit unions have an initial membership fee and minimum deposit amount to open an account. Some base membership on geographic areas, industries, or associations. Review requirements before applying.

How difficult is the business loan application process?

Having organized financial documents and a solid business plan facilitates the process. Expect to submit tax returns, bank statements, P&L statements, business debt schedules, and other items that convey your business health and repayment abilities.

Can small startups qualify for credit union financing?

Absolutely. Credit unions recognize startups need access to capital to get off the ground. Solid business plans and personal credit scores can help new businesses qualify. The key is choosing a credit union aligned with small business goals.

How do credit unions support local business networks and events?

Many credit unions host networking events, seminars, workshops, and other activities. Sponsorship, partnership opportunities, and event participation provide exposure along with relationship-building and mentorship benefits.