Table of Contents

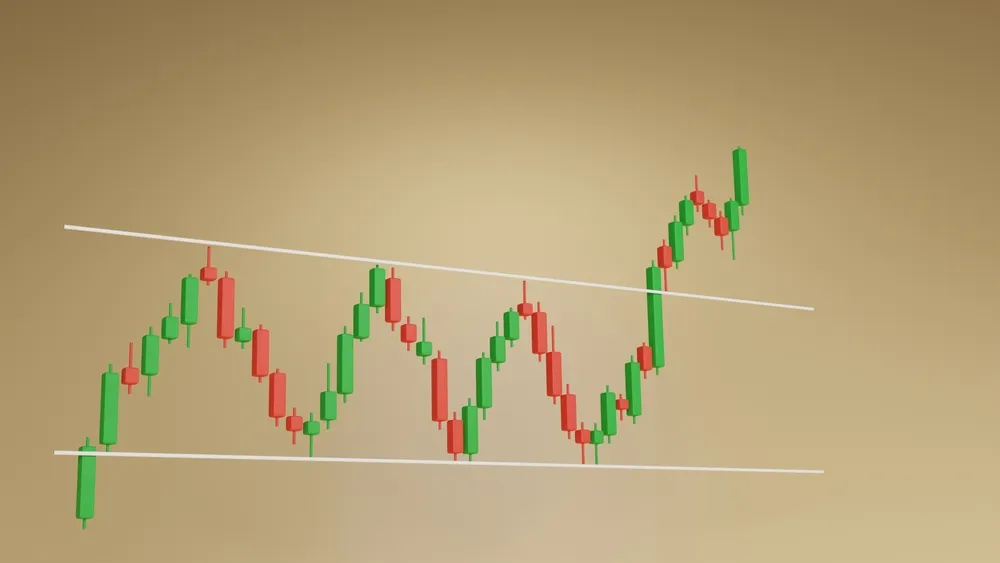

Trading in the financial markets often involves recognising and interpreting various chart patterns. Among these, the flag pattern stands out as a significant indicator for traders. However, mastering this pattern requires understanding common pitfalls and learning how to avoid them. This article dives into these mistakes and offers practical advice to navigate them effectively.

Recognise False Breakouts

A common challenge in this trading is misinterpreting false breakouts. Traders might jump into a trade assuming the pattern has been completed, only to find the price moving against their expectations. It’s crucial to confirm breakouts with additional indicators or wait for a precise price movement beyond the flag boundaries. To improve accuracy, look for high volume during the breakout, as it often signifies a more substantial market commitment.

Be wary of breakouts that occur on low volume, as they may lack the momentum needed for a sustained move. Also, consider using trend lines and moving averages to validate the breakout direction, providing an extra layer of confirmation before entering a trade.

Avoid Overtrading

When investors spot it, the excitement can lead to overtrading. This eagerness often affects coming into a couple of positions without proper analysis, increasing the danger of losses. It’s vital to be patient, analyze every setup thoroughly, and ensure it aligns with your universal trading strategy.

Set strict standards for what constitutes a viable flag formation and cling to it. Avoid the temptation to trade each pattern you notice; rather, awareness of nice over quantity. Remember, hit trading isn’t about the range of trades but the best and consistency of your method.

Ensure Proper Position Sizing

Another mistake is unsuitable function sizing. It’s tempting to allocate giant capital to a perceived excessive-possibility exchange. However, this can result in disproportionate losses if the trade goes against you. A balanced technique to place sizing is vital to handling danger successfully.

Use hazard control gear just like the Kelly Criterion or constant percentage models to decide the perfect length for each change. Continually check the potential drawback of an alternate and ensure it aligns with your danger tolerance. You hold a buffer in opposition to market volatility and sudden effects via retaining function sizes in the test.

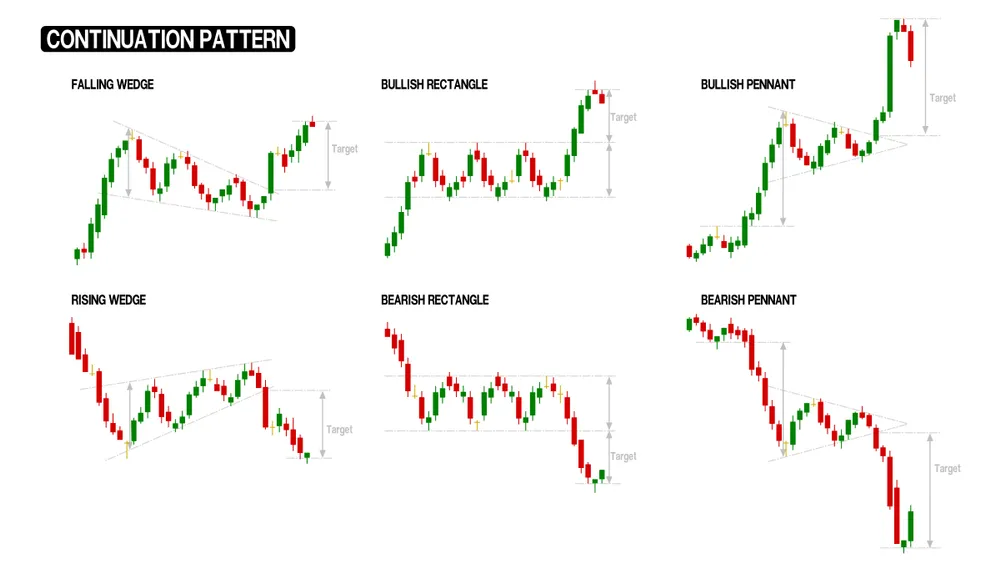

Watch for Market Context

Ignoring the broader market context is a frequent oversight. The flag formation doesn’t exist in isolation. Factors like market trends, economic news, and sector performance can influence its effectiveness. Traders should always consider the bigger picture before making decisions based on this pattern.

Understand the current market phase, whether it’s bullish, bearish, or ranging, as this affects how the flag pattern might play out. Pay attention to related assets or sectors, as their movements can provide valuable insights. Also, be mindful of upcoming economic events or announcements that could significantly impact market sentiment and price action.

Use Stop-Loss Orders Wisely

Finally, neglecting to apply stop-loss orders or setting them improperly can bring about big losses. A prevent-loss order protects your function with the aid of automatically maintaining it at a predetermined loss stage. Placing it too near the entry point can cause untimely exits even as setting it to some distance can growth losses.

The secret is to find stability, setting the forestall loss at a stage that permits a few market fluctuations but protects in opposition to vast downturns. Consider the volatility of the asset and regulate your forestall-loss thus. It’s additionally useful to periodically evaluate and modify prevent-loss orders because the trade progresses, locking in income and lowering exposure.

Final Thought

As in all trading strategies, it’s crucial to approach each opportunity with caution and diligence in flag pattern trading. By avoiding these common mistakes, traders can enhance their chances of success. Remember, trading is about recognising patterns, managing risks and adapting to the ever-changing market dynamics.